Whether you’re a new or experienced real estate investor, you may have asked, “What is a real estate short sale?” The simple answer is that a short sale is when a homeowner owes more for their home than its current market value and puts it up for sale. Their short sale mortgage is said to be “underwater,” if they secure a buyer, they must get bank approval to proceed with the sale. In this guide, I cover what is a short sale real estate, its unique sales process, legal considerations, where to find short sale properties, and tips to succeed. Let’s begin!

What Happens in a Real Estate Short Sale?

A real estate short sale occurs when a homeowner sells their property for less than the outstanding mortgage balance with the lender’s approval. Typically initiated due to financial distress, short sales require negotiation strategies with the lender and may take longer than traditional transactions.

While the homeowner avoids foreclosure, the process can have credit implications and potential tax consequences. The lender will likely report the short sale to the credit bureaus, and homeowners may have to pay income tax on the difference between the purchase price and unpaid mortgage balance. Therefore, knowing market conditions and regulations surrounding short sales is essential for real estate investors and agents.

Differences Between a Short Sale vs Foreclosure

The primary difference between a short sale and foreclosure lies in the homeowner’s involvement. In a short sale, the homeowner is the one who sells the property to avoid foreclosure. Foreclosure is a legal process initiated by the lender to repossess the property due to non-payment. Short sales give homeowners some control, while foreclosure results in property loss. A short sale can coincide with a preforeclosure. A preforeclosure is the period before a foreclosure, during which the seller has received notification of pending foreclosure and has time to list and sell the property.

Many sellers price their homes for sale based on what they owe and to cover their closing expenses. These homes are often advertised as “motivated sellers” or state that they are in preforeclosure or short sale. Preforeclosures, foreclosures, and short sales all provide an opportunity to get a good deal on a home.

Legal Considerations of Short Sales

Short sales come with legal considerations, so consulting with legal professionals is essential for all parties to avoid pitfalls. Investors need to be cautious of anti-flipping regulations and potential tax implications like capital gains tax or a taxable income event on the forgiven debt and ensure their contracts with lenders allow flexibility for delays. They must also be mindful of how this impacts their interest rate and terms.

Obtaining a clear title is also critical, so investors must conduct comprehensive research and due diligence. Inspect the property’s condition, title, and existing liens or encumbrances. A complete inspection and title search ensures the investor doesn’t inherit existing problems. Any clouds on the title, such as outstanding liens or legal disputes, could pose challenges. Other considerations include:

| Seller Legal Considerations | Buyer Legal Considerations |

|---|---|

|

|

How Do Short Sales Work for Investors?

Short sale homes are more involved than traditional home sales. It requires patience, coordination, and a thorough understanding of the process and challenges that this type of sale entails. A seller needs to maximize the home’s value, while a buyer or investor may seek an opportunity for a deep discount.

Suppose you work with a real estate agent to buy or sell a short sale. In that case, the agent’s role is to bring the buyer and seller together, understanding that it is ultimately up to the lender to decide if the buyer’s offer is acceptable. Let’s look at each scenario and some tips to help you navigate this delicate sales process.

Short Sale Requirements for Sellers

A homeowner must know how to initiate a short sale. Before listing their home, they must discuss the potential for a short sale with their lender. Sellers must prepare to provide documentation showing they are in financial need. They will be asked to show they have no other resources to cover missed payments, fees, or the remaining mortgage balance if the home sells below what’s still owed. Lenders are not required to accept a short sale but may be open to it if the foreclosure costs outweigh the financial loss. Here are some information the lender may require from sellers before agreeing to a short sale:

Sellers need to know that they can’t make a short sale to free up money to pay their revolving or consumer debts. If the homeowners make on-time payments for their credit cards and other debts, the bank may expect them to apply those payments toward their mortgage and default on the other debt. If the seller has different assets, the bank may expect those to be sold first to cover the mortgage balance.

Buying a Short Sale Home

Buying short sale real estate involves research, education, and due diligence. Buyers and those looking to begin investing in real estate must understand the potential risks and challenges of short sales, like extended deadlines and the seller’s lender approval. Here are considerations for investors and buyers:

Pros & Cons of a Real Estate Short Sale

Short sales can provide some relief for distressed sellers and may negatively impact their credit less than a foreclosure. However, short sales also take longer to close, and the sellers may still face damaged credit scores. Here are more short sale pros and cons to consider regarding short sale.

| Short Sale Pros | Short Sale Cons |

|---|---|

|

|

|

|

|

|

|

|

The Real Estate Short Sale Process

Now that you’re clear on “what is a real estate short sale?”, it’s time to learn how a short sale is conducted. Whether you’re an investor buying or selling a short sale property, these steps must be carefully employed to ensure a successful transaction:

Step 1: Homeowner Discusses Short Sale Options With the Bank

All short sales begin with a conversation between the seller and the mortgage lender. This is not the same as getting lender approval. Approval is when the lender has reviewed a buyer’s offer and agrees to allow the seller to proceed with the transaction. This meeting is for the sellers to learn more about the bank’s short sale requirements. The lender may also provide a list of items needed from the sellers to decide if a short sale is feasible.

Step 2: The Real Estate Agent Prepares a CMA

A comparative market analysis (CMA) is a report prepared by a real estate agent to determine the fair market value of a property. The agent collects market data on comparable properties that have recently sold and are currently for sale. Agents may also include expired listings to show similar homes that didn’t sell due to overpricing. The bank may require this CMA to support a seller’s listing price.

Step 3: The Home Is Listed for Sale

The seller lists the home with an agent who begins advertising the property, or the seller lists it as a for-sale-by-owner (FSBO) listing. The agent discloses the short sale in the listing details so prospective buyers understand that their offers are subject to lender approval. This is essential since some buyers may need a quick closing to move forward with their plans.

Step 4: Real Estate Marketing Spreads the Word

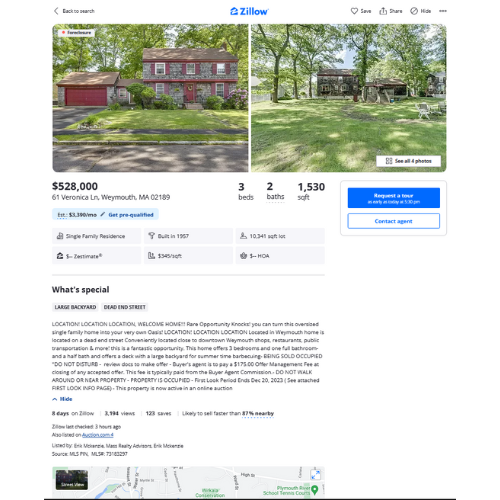

Short sales can be marketed like regular listings through online sites, social media, multiple listing services (MLS), yard signs, brochures, and flyers. Investors can also find them in open houses and property tours. Sellers of short sale properties may not want a for-sale sign on their home or their address disclosed online, so they’re not always easy to spot, except for the disclosure in the details. Agents may share the benefits of these marketing options, but ultimately, it is the seller’s decision.

Use free sites like Zillow to attract prospective buyers to your short sale listing. Ensure the homeowner is on board with your posting and upload photos and property details. You can leave out the address to stay discreet. Create a listing for free on Zillow today.

Step 5: Interested Buyers Make Offers

Buyers interested in the short sale submit offers and are made aware of the complexities. When an offer is accepted, the seller presents it to the lender for approval, recognizing the potential for rejection and a lengthy short sale timeline. It is up to the lender to allow the sale to proceed. Agents must carefully prepare offers and acknowledge the nuances of short sales, emphasizing the need for patience and strategic planning throughout the process to ensure a successful closing.

Step 6: Due Diligence Begins

Buyers in a short sale should conduct home inspections, title searches, and appraisals to uncover property issues, confirm clear ownership, and assess market value. They should also notify their lender about the short sale to accommodate potential delays, consider locking in favorable loan rates, and understand mortgage extension policies and fees. These actions ensure a smooth transaction and financing.

Step 7: Sellers Find Suitable Housing

Real estate agents should help sellers find suitable housing, as short sale closings can take time and landlords may not wait. The lender may require partial or full loan payments during the short sale process for sellers, so funds may not be available for rental prepaid, like the first and last month’s rent and a security deposit. If the sellers can afford it, they may want to start paying rent in a new place even if they don’t move in immediately.

It’s unlikely that there will be net proceeds to the seller at the closing, so they must have a plan for where they will go and how they will pay for it. Listing agents and sellers must figure this out early in the short sale process. Sellers may move in with friends or family or rent a room in a motel until they find a rental. Defaulted mortgage payments could damage the seller’s credit, so renting could prove challenging.

Step 8: All Parties Attend the Closing

The buyers officially acquire the property, and agents receive compensation. Lenders retain the balance of the proceeds from the sale. Sometimes, sellers may need to contribute funds to cover the disparity between the selling price and the outstanding mortgage. The closing marks the culmination of the short sale process, solidifying property ownership and completing financial transactions among the buyers, sellers, and lenders.

Where to Find Short Sales

Investors must be sensitive when approaching sellers of short sale homes. Usually, these properties are listed for sale and advertised online, in the MLS, and on sites like Zillow and Realtor.com. However, there are other steps to take to find short sale homes and investment properties for sale. Here are some methods to consider:

How to Succeed at a Real Estate Short Sale

You can take some steps when selling a short sale property to help the home sell quickly and move toward a smooth closing. Here are some tips to help with your short sale:

- Home staging: Make the home look as inviting as possible by removing clutter and arranging furniture and decor.

- Motivated sellers: Use persuasive language in listing details such as “motivated sellers.”

- Preplan your strategy: Since timing is crucial for a successful short sale, have a plan for marketing the property and coordinating the transaction.

- Stay within 10% of market value: While the homeowner needs to extract as much value from the home as possible, it’s counterproductive to overprice the listing, hoping a buyer will purchase it. Listing within 10 percent of the market value doesn’t put it so high that it repels prospective buyers.

- Offer non-financial incentives: Sellers may not be able to offer help with closing costs or repairs due to financial constraints. However, offering a home warranty for the first year may only cost a few hundred dollars.

- Keep buyers and sellers informed: Communication between buyers, agents, lenders, and sellers must be maintained. Everyone is busy, but you don’t want buyers to lose interest, and you must make sure the lender has all the information it needs to proceed.

Frequently Asked Questions (FAQs)

Who pays the real estate commission in a short sale?

The lender pays the real estate sales commission from the sale proceeds as part of the seller’s closing costs. The seller doesn’t pay it out-of-pocket; it’s part of the negotiated deal with the lender.

Is a quick sale and a short sale the same thing?

No. A quick sale closes rapidly, while a short sale involves selling a property for less than the mortgage balance, requiring lender approval and often taking longer. However, a quick sale can sometimes be part of the short sale process if the buyer offers enough to satisfy the existing mortgage debt before foreclosure.

Is a short sale good or bad for a buyer?

A short sale can be both good and bad for a buyer. Buyers may secure a property at a discounted price, but face a lengthy, uncertain process with no guarantee of lender approval. Buyers must be patient and aware of potential complications, such as property conditions and outstanding liens.

Does a short sale affect your credit?

Yes. While a short sale can lower your credit score, it’s still less damaging compared to a foreclosure.

Bringing It All Together

This ultimate guide on “What is a real estate short sale?” addresses what investors, agents, buyers, and sellers must know when engaging in this nuanced transaction. All parties must work diligently to ensure deadlines are met, and communication is timely. Sellers must get their documentation to the lender, but it is ultimately up to the bank to proceed.

Do you have any questions about what is a short sale real estate? Let us know in the comments!

The post What Is a Short Sale in Real Estate? The Ultimate Guide appeared first on The Close.