Performing a rental market analysis (RMA) is essential for understanding a property’s income potential. An RMA involves in-depth research on comparable rental properties—scrutinizing local amenities and calculating formulas that include average rental rates. This meticulous examination of data reveals whether a property is likely to generate positive or negative cash flow and aids in investment decisions. Read through to learn how an RMA will help you make smarter investment decisions and maximize your property’s potential.

What Is a Rental Market Analysis?

A rental market analysis (RMA) is a forecast that evaluates specific criteria to help you determine the rental potential of a specific area and property. It examines factors influencing the renting market, such as property location, size, condition, and amenities. This data is subject to constant fluctuations, so investors must conduct frequent RMAs to stay abreast of the ever-changing real estate market.

Why Is Rental Market Analysis Important?

One purpose of an RMA is to help real estate investors determine whether a property is worth purchasing based on its potential rental income. Additionally, an RMA assists in setting the optimal rental price in a competitive market. This ensures landlords maximize returns and make informed decisions when their property is vacant.

Real estate professionals can use an RMA in the following ways:

Steps for Performing a Rental Market Analysis

Completing a comprehensive rental market analysis involves a sequential process of six distinct steps. These steps serve as a roadmap for gathering data, conducting studies, and drawing meaningful conclusions about the current market rate for rent. By progressing through each step, property investors can expect to emerge with an understanding of the rental landscape and current rental costs within their chosen area.

Step 1: Define Your Rental Objectives & Select Your Research Resources

Before embarking on a rent analysis, it is important to clearly define your objectives. Whether you are seeking maximum profitability, aiming to assess potential opportunities, or evaluating the performance of your current rental property portfolio, your objectives will serve as a guiding compass to direct the rental rate analysis toward uncovering specific information to meet your objectives.

Once your rental objectives are established, you must select the research resources carefully. The quality and reliability of your data sources significantly impact your RMA’s accuracy and effectiveness. Reliable real estate websites, local listings, and market reports will be your primary sources of information. Leveraging a combination of these resources provides a well-rounded perspective that can strengthen the foundation of your rental analysis.

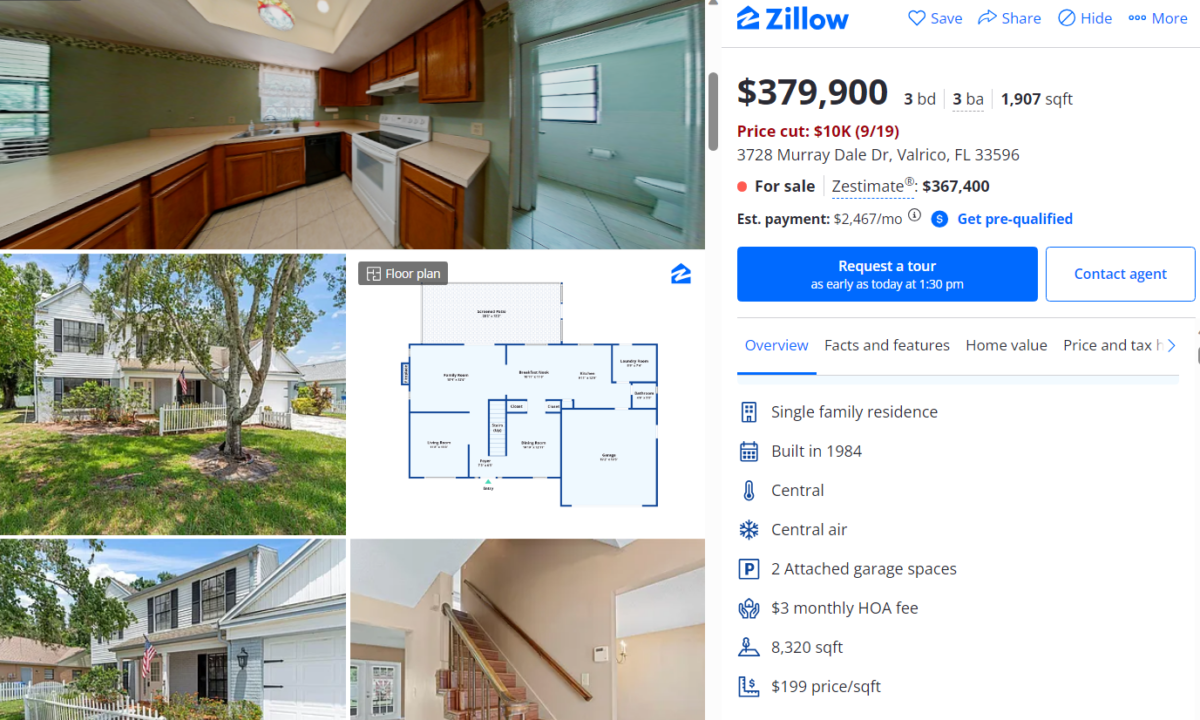

If you’re working with a real estate agent, they can provide access to the multiple listing service (MLS). The MLS database houses data for all properties currently on the market, pending, sold, and rented. Many popular real estate listing websites, like Zillow and Realtor.com, offer valuable rental property details like square footage, lot size, and property features.

Step 2: Collect Comprehensive Information on the Subject Property

Gathering comprehensive property information is the foundation of a thorough rent analysis. This initial step involves collecting a wealth of data about the property you’re analyzing, whether a potential or recently purchased property or one you already own. You’ll need details about its size, layout, amenities, condition, and historical rental income. Also, gather the following relevant data for the property in question:

- Utility information: Details about heating and cooling systems, energy efficiency, and utility costs.

- Parking: Information on parking options (i.e., whether there is on-site parking, a garage, or street parking).

- Appliances: The presence and condition of refrigerators, stoves, dishwashers, and washers/dryers.

- Flooring and finishes: The type and condition of flooring and the quality of finishes impact a property’s visual appeal.

- Outdoor space: Properties with patios, balconies, or gardens are often more attractive to tenants, especially in specific markets.

- Security features: Features like a security system, gated access, or secure entry can enhance tenant safety and comfort.

- Pet-friendliness: Policies regarding pets can influence a property’s marketability.

- Public transportation: Proximity to bus stops or subway stations can be a significant selling point, particularly in urban areas.

- Neighborhood amenities: Access to nearby amenities like grocery stores, restaurants, parks, and entertainment venues can affect a property’s marketability and rental price.

To be helpful, the data you collect must also be effectively organized. By inputting the collected data into a spreadsheet, you create a central repository that houses all the essential information in an organized and easily accessible format.

Step 3: Assess the Surrounding Neighborhood

The surrounding neighborhood provides information about how well your property would resonate with prospective renters. The quality of schools, transportation options, safety, nearby parks, recreational areas, and the overall sense of community are pivotal in shaping a tenant’s decision. Understanding these neighborhood attributes allows property owners and investors to position their rental property prices more effectively in the market.

While a neighborhood alone doesn’t determine the rental price, it gives a perspective on whether you can attract responsible and quality renters. Investors should focus on gathering data that provides insight into property appreciation, tenant demographics, and rental demand within a neighborhood. This information helps you make more informed decisions about property acquisition in a specific area.

Step 4: Gather Data on Comparable Properties

Identifying and gathering data on comparable properties in a rent analysis is crucial for understanding how your property compares with the current rental market. These similar properties are benchmarks for evaluating the subject property’s rental potential.

Seek properties that closely resemble the subject property in size, condition, and amenities. Focus on listings that are currently available or have been recently rented in the same neighborhood. Here are items to look out for:

- Proximity to each other: In an urban area, they should be within a three-block radius. Properties in a suburban area should be within a couple of miles, and rural areas may be even further away.

- Square footage: All properties should be within a couple of hundred square feet in size.

- Rent price: Although you may not have the final calculations for your rent price yet, find properties for rent in a similar price range that you expect to charge.

- Number of bedrooms: Must be the same in all comps; don’t compare a one-bedroom with a two-bedroom.

- Number of bathrooms: Should be as similar as possible, although you can compare two and 2.5 bathrooms.

- Lot size: The lot size should be like square footage. This is an essential factor for single-family homes in particular.

- Condition: Needs to fall in the same category, such as updated, original, distressed, etc.

- Amenities: Similar amenities in the unit and building; if not, you can adjust for them.

- Days on Market (DOM): If a property has been sitting on the market for over 60 days, it may be priced too high or have some type of flaw. Adjust the price by about 5%, depending on why the DOM is so high.

All the data points collected on your property in step two should be the exact data points you collect on comparable properties. This will make it easier to compare your subject property side-by-side with the comparable properties.

Step 5: Perform Necessary Calculations

Once you’ve collected data on the subject property and comparable rentals, it’s time to perform essential calculations. With data already organized within a spreadsheet, you can input the necessary figures into formulas and equations to derive the results. Here are the main calculations you must complete.

Average Rental Price

Calculating the average rental price for comparable properties in the area provides a baseline for determining competitive rental rates. This information helps make rent attractive to tenants and financially viable for the property owner.

Average Rental Price = (Total Rental Income per Property) / Number of Comparable Properties

- Example: If you have three comparable properties with rental incomes of $1,500, $1,600, and $1,700, the average rental price is: (1500 + 1600 + 1700) / 3 = $1,600 per month.

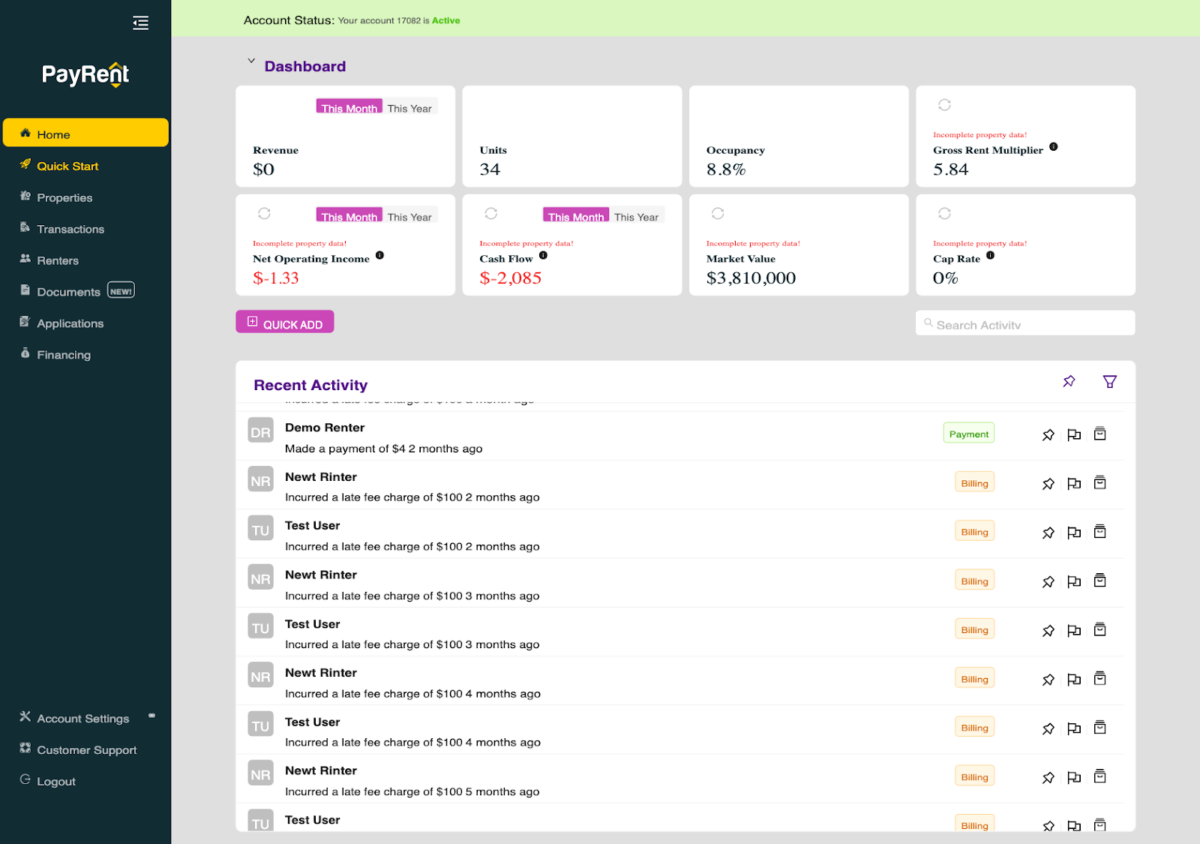

Gross Rent Multiplier (GRM)

The GRM is calculated by dividing the property’s market value by its annual rental income. It helps assess the property’s potential return on investment (ROI) and allows property investors to evaluate different investment opportunities quickly.

Gross Rent Multiplier = Property Market Value / Annual Rental Income

- Example: If a property’s market value is $300,000 and it generates an annual rental income of $24,000, the GRM would be $300,000 / $24,000 = 12.5.

Cash Flow Analysis

The cash flow market rent analysis involves estimating the property’s operating expenses (e.g., property taxes, maintenance, insurance) and subtracting them from the rental income to determine its net cash flow. This calculation is essential to understand whether the property will likely generate positive or negative cash flow.

Cash Flow = Monthly Rental Income – Monthly Operating Expenses

- Example: If a property generates $2,500 in monthly rental income and has $800 in monthly operating expenses (including taxes, maintenance, and insurance), the monthly cash flow would be: $2,500 – $800 = $1,700.

Cap Rate (Capitalization Rate)

The cap rate is calculated by dividing the property’s net operating income (NOI) by its market value or acquisition cost. It provides insight into the property’s potential profitability and allows for comparisons with other investment opportunities.

Cap Rate = Net Operating Income (NOI) / Property Market Value

- Example: If the NOI is $30,000 and its market value is $400,000, the cap rate is: $30,000 / $400,000 = 0.075 (or 7.5%).

Return on Investment (ROI)

ROI is calculated by dividing the net profit from the property (income minus expenses) by the initial investment cost. It helps property investors assess the potential return on their investment and make informed decisions about whether to acquire or hold a property.

Return on Investment = (Net Profit / Initial Investment) × 10

- Example: If you invest $100,000 in a property, and it generates a net profit of $12,000 annually, the ROI would be: ($12,000 / $100,000) × 100 = 12%.

Break-even Analysis

This analysis determines the point at which the property generates enough income to cover all expenses and debt service. It helps property owners understand when they will start making a profit from their investment.

Break-even Analysis = Total Monthly Expenses / (Rental Income – Monthly Expenses)

- Example: If your total monthly expenses are $1,200, and your property generates $2,000 in monthly rental income, the break-even point would be: $1,200 / ($2,000 – $1,200) = 2.4 months.

Vacancy Rate

Calculating the vacancy rate helps property managers estimate the potential loss of rental income due to vacancies. It aids in setting aside funds for vacancies and optimizing marketing efforts to reduce downtime.

Vacancy Rate = (Number of Vacant Units / Total Number of Units) × 100

- Example: If you have four vacant units out of a total of 40 units, the vacancy rate would be: (4 / 40) × 100 = 10%.

Operating Expense Ratio

This ratio is calculated by dividing the property’s operating expenses by its gross income. It provides insight into the efficiency of property management and can help identify areas where cost savings may be possible.

Operating Expense Ratio = (Total Operating Expenses / Gross Rental Income) × 100

- Example: If your total operating expenses are $24,000, and your gross rental income is $80,000, the operating expense ratio would be: ($24,000 / $80,000) × 100 = 30%.

Return on Equity (ROE)

ROE assesses the return earned on the property investment compared with the equity invested in the property. It helps property owners evaluate their investment performance in terms of the equity they have in the property.

Return on Equity = (Net Profit / Equity Invested) × 100

- Example: If you have $50,000 of equity in a property, and it generates a net profit of $6,000 annually, the ROE would be: ($6,000 / $50,000) × 100 = 12%.

Since each investor’s objectives and circumstances are unique, it’s essential to acknowledge that the ideal numbers for these equations will vary accordingly. For investors with larger portfolios, evaluating these numbers in the context of your current portfolio can be especially helpful. This assessment allows you to determine if the performance of new or prospective properties aligns with your established investment strategy and broader financial goals.

Step 6: Analyze the Price of Properties & Make Informed Decisions

The final step in the apartment rental market analysis process is to make informed decisions based on the insights gathered. If you’re using an RMA to purchase a new property, consider the rental potential and the purchase price against the broader real estate market. If the purchase price of a property is significantly higher than what you can reasonably expect to generate in rental income, it may not align with your investment goals.

On the contrary, an abundance of low-priced properties in a particular area should also raise concern. For example, a surplus of similar properties for sale in close proximity may indicate a potential oversupply in the rental market. This oversaturation can lead to extended vacancy periods and financial challenges due to carrying costs without rental income.

For a rent market analysis used in determining the optimal rental rate for your property, property owners can strike a balance between attracting tenants and ensuring profitability. Setting the right rental rate in line with the comparable properties on the market is a strategic move that impacts your investment’s success. By aligning your rental rate with the prevailing market conditions, you make your property more competitive, attracting potential tenants with a fair pricing structure.

Landlords can use PayRent to simplify collecting rent payments and tracking financial performance for their properties. The platform’s tools can complement a rental market analysis by providing insights into payment trends and tenant’s payment behavior.

Frequently Asked Questions (FAQs)

How can I use the RMA to improve my rental property’s performance?

An RMA helps you identify in-demand features, assess comparable rental rates, and set a competitive price for your property. Use these insights to make strategic upgrades and attract or retain tenants. This ensures stable rental income and keeps your property aligned with market expectations.

How often should I conduct a rental market analysis?

Conducting an RMA annually is a good starting point, but investors may adjust the frequency based on market volatility and investment goals. Dynamic markets or new acquisitions may require more frequent analysis. On the other hand, stable properties in steady markets can be reviewed less often.

Who can use data from an RMA?

Data from a rent market analysis is helpful for property investors, landlords, managers, real estate agents, brokers, and tenants. It helps stakeholders decide on pricing, acquisitions, management strategies, and market conditions. Essentially, anyone involved in rental property transactions can benefit.

Bringing It All Together

Conducting a thorough rental market analysis helps property managers and investors assess rental potential and set competitive rates. By evaluating factors like location, size, amenities, condition, and days on market, you can make informed decisions and optimize rental property performance.

Have any questions about creating a rental market analysis? Let us know in the comments!

The post Rental Market Analysis (RMA): A Complete Guide for Investors appeared first on The Close.