Seeing how Airbnb has revolutionized how people travel and invest in real estate, the thought of starting an Airbnb business must have crossed your mind dozens of times. But how do you even begin? In this guide on how to start an Airbnb business, I’ll break down the seven essential steps, from financial planning to daily operations, to help you navigate Airbnb entrepreneurship.

Step 1: Understand the Differences Between Airbnb & Traditional Investment Properties

Airbnb and traditional investment properties serve different markets with unique expectations and management styles. Owning an Airbnb typically means short-term rentals—offering fully furnished accommodations for vacationers or travelers. These often yield higher monthly rental income than traditional rentals, but this comes with greater host involvement in frequent cleaning, maintenance, and guest communication.

On the other hand, traditional investment properties—also known as long-term residential rentals—usually provide a steady monthly income with longer tenant leases. They generally require less daily management, flexibility in pricing, and tenant turnover.

Here is a simplified table comparing the two types of investments:

| Feature | Airbnb Investment Property | Traditional Investment Property |

|---|---|---|

| Rental duration | Short-term (days to weeks) | Long-term (months to years) |

| Income potential | Higher per-night rates | Steady monthly income |

| Management intensity | High (frequent guest turnover) | Lower (longer tenant stays) |

| Legal and regulatory concerns | Strict and varied local laws | Standard residential tenancy laws per state |

| Flexibility in pricing | Dynamic, based on demand | Fixed, based on lease agreements |

| Initial setup costs | Higher (furnishing, listing) | Lower (typically unfurnished) |

| Guest/tenant interaction | High (check-ins, communication) | Minimal (set lease terms) |

When starting an Airbnb, investors should consider several critical factors. Assess the market demand and competition in the desired area to ensure a profitable venture. Understand the commitment involved, including the time and resources needed for daily operations, guest communication, and property maintenance.

Consider the financial implications, such as initial investment, ongoing costs, and the potential for fluctuating income based on seasonality and market trends. Also, reflect on your personal goals and lifestyle, as owning an Airbnb requires a hands-on approach and can significantly differ from traditional investment properties or other forms of passive income.

Step 2: Learn the Legal Framework & Compliance for Airbnb

Given the diverse and often stringent regulations governing short-term rentals, investors should understand the legal landscape before setting up an Airbnb. It is subject to local laws, including short-term rental regulations, tourism taxes, and sometimes stricter zoning laws. The reasons for the stringent regulations are due to the following concerns:

- Community impact: Short-term rentals can significantly affect local communities. Issues can arise related to noise, safety, and housing availability. This is particularly evident in areas where rental properties are converted to short-term lets, reducing long-term rental supply. Regulations are often designed to mitigate these impacts.

- Tourism control: Many cities rely on tourism but must balance it with local quality of life. Regulations may aim to control the number of tourists in certain areas, maintain the character of neighborhoods, and ensure that tourism growth is sustainable and beneficial to the local economy.

- Fair competition: Traditional lodging businesses, like hotels, are subject to regulations and taxes. As Airbnb operates in the same market, local laws aim to level the playing field by ensuring short-term rentals meet similar standards and tax obligations.

- Safety and standards: Regulations often enforce safety standards for guests, including fire safety, health standards, and building codes, similar to other accommodation services.

- Revenue collection: Tourism taxes, like hotel occupancy taxes, are a significant revenue source for many local governments. Applying these taxes to Airbnb rentals ensures that the city benefits financially from the tourism facilitated by these platforms.

- Zoning laws: Residential zones are typically intended for long-term housing, so some cities enforce strict zoning laws to limit short-term rentals.

Pro-tip: Understanding how to start an Airbnb business should encourage investors to do their due diligence. You can do this by researching zoning laws, licensing requirements, and specific restrictions on short-term rentals in the area you want to have an Airbnb. Additionally, if your property falls under the jurisdiction of a Homeowners Association (HOA), you must review and adhere to its bylaws.

Some may have restrictions or outright bans on short-term rentals. Ensuring compliance with these various legalities avoids penalties. It allows you to invest your money in a legally sound, sustainable venture that is more likely to yield long-term benefits and maintain good standing in the community.

Step 3: Plan the Finances for Your Airbnb Business

Learning how to start an Airbnb business goes beyond the initial property purchase and requires thoughtful financial planning. Before diving in, accounting for all costs is key to running a profitable rental property. Here are some things to consider:

- Budget early: Investors should create a detailed budget or business plan. Factor in initial setup costs, such as renovation and furnishing, and ongoing expenses, like utilities, maintenance, and cleaning.

- Prepare for surprise expenses: In addition to accounting for Airbnb’s service fees, you should set aside funds for unexpected repairs. Develop a dynamic pricing strategy that reflects demand fluctuations, local events, and slow booking periods.

- Understand taxes: Income, property, and occupancy taxes are necessary. Effective financial planning enables hosts to price their listings competitively, cover all costs, and ensure a profitable and sustainable business model.

Pro-tip: Consider maintaining separate financial accounts for personal and business transactions. Keeping meticulous records for tax purposes and considering professional accounting support can be helpful to an Airbnb investor.

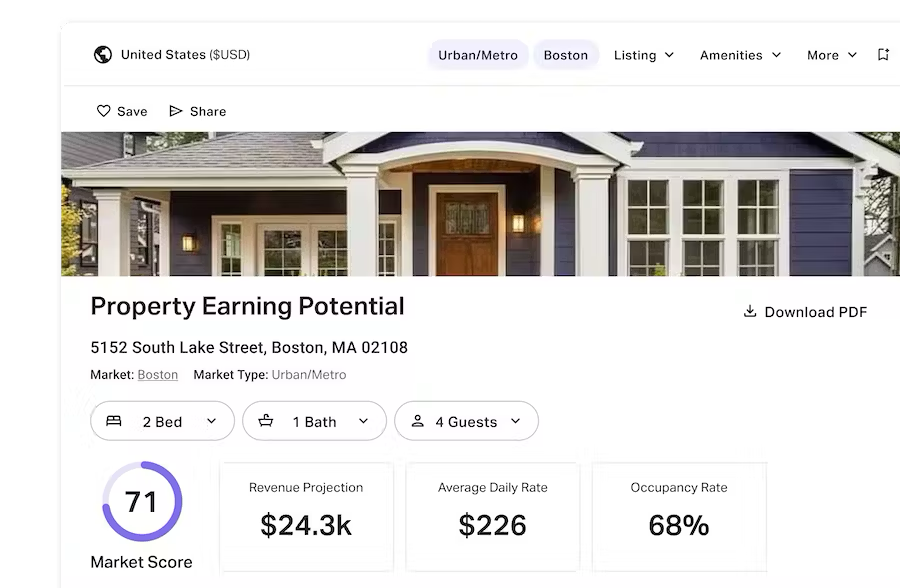

Platforms like AirDNA can help investors learn how to start an Airbnb and understand how to price their property by providing comprehensive market data and analytics. These offer insights into revenue potentials, occupancy rates, and competitive pricing strategies within specific locales. By analyzing trends, seasonality, and even event-driven demand, investors can optimize their pricing to maximize occupancy and revenue.

Step 4: Structure Your Business & Financial Management

For many investors, forming a Limited Liability Company (LLC) or real estate holding company is preferred due to its distinct separation between personal and business assets and potential tax benefits. An LLC can protect your business while enhancing its professionalism.

However, not every Airbnb is listed under an LLC, and other business structures exist. Some Airbnb hosts operate as sole proprietors, which is the simplest approach but lacks liability protection. Those planning to scale their business may consider an S Corporation (S Corp) for less self-employment taxes, though it comes with more complex IRS requirements.

If you want to be a small-scale host managing just one property or part of your home, the additional complexity and cost of forming an LLC might not be justified. Personal homeowners’ insurance and additional short-term rental coverage might be sufficient for your liability needs without needing an LLC’s protection.

Also, some investors may find that their current mortgage or property management agreements have stipulations or complexities that make transferring to an LLC disadvantageous or impractical. For those just testing the waters of being an Airbnb host or doing it casually, the informal structure without an LLC can be a more straightforward way to start.

Below are some pros and cons of operating your Airbnb under an LLC:

| Pros of an LLC for Airbnb | Cons of an LLC for Airbnb |

|---|---|

|

|

|

|

|

|

|

|

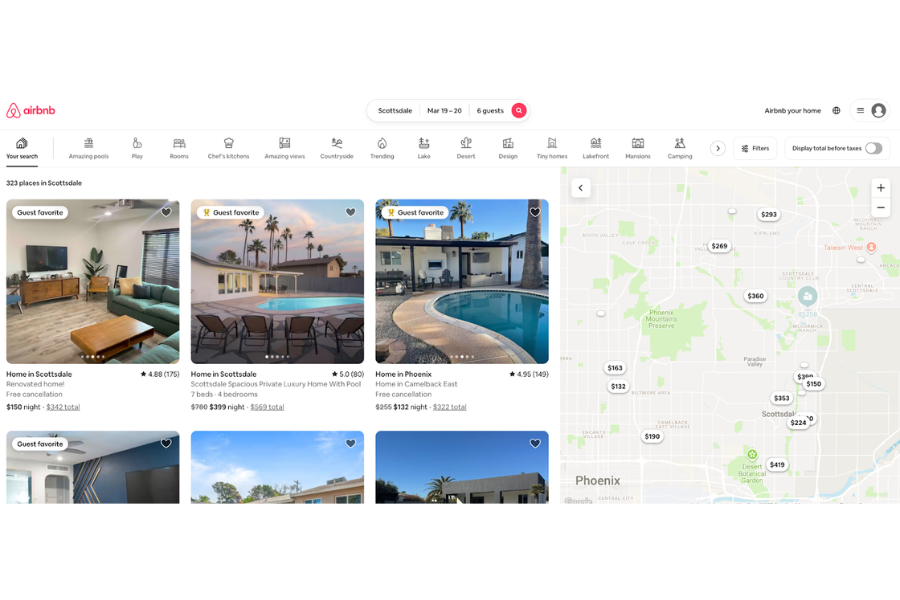

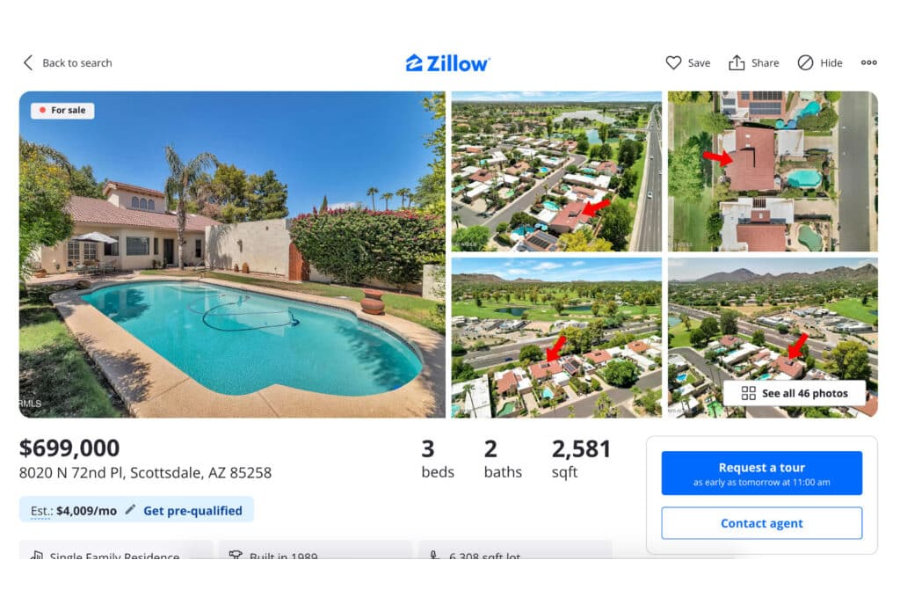

Step 5: Select the Ideal Property for an Airbnb Investment

Owning an Airbnb in an ideal property and location is pivotal in establishing a successful Airbnb business. The right choice can lead to high occupancy rates, positive reviews, and increased revenue—while a poor choice might result in the opposite.

The first step is understanding the market demand in your target area. Research popular destinations, understand the seasonal flux of tourists, and identify any events or attractions that draw visitors. Then, take a look at the competition nearby. Understand what kinds of properties are available and their occupancy and pricing strategies.

Properties in central, accessible areas or nearby major tourist attractions typically command higher prices and enjoy higher occupancy rates. However, these properties might also have higher purchase prices and more stringent regulations. If marketed correctly, unique or secluded properties can attract a niche market. Accessibility is key, so properties should ideally be near public transport and airports or have convenient parking options.

Why the Location of Your Airbnb Matters

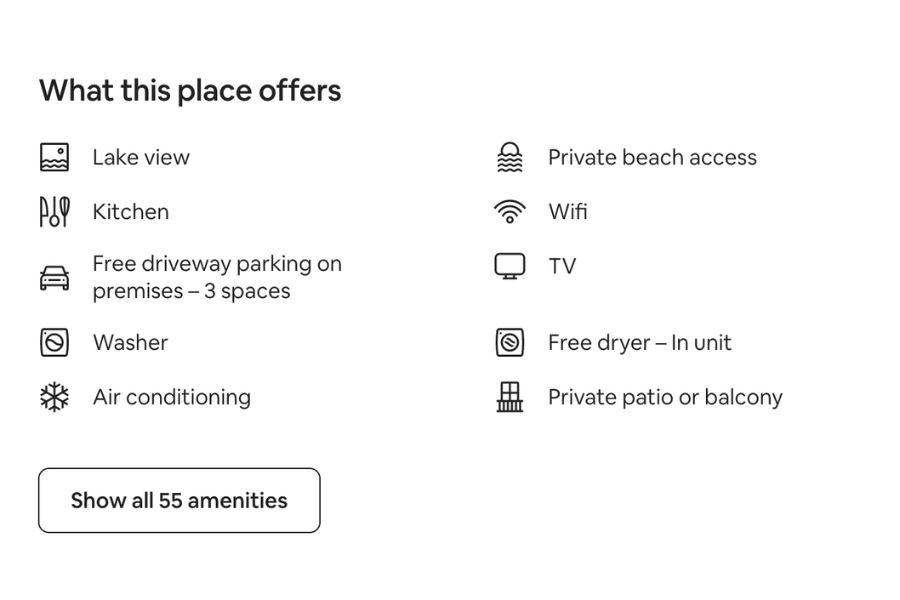

The property is just as crucial as its location when learning how to start an Airbnb business. Consider the type of guests you want to attract and ensure the property meets their needs. For example, families might look for multiple bedrooms and a kitchen, while business travelers might prioritize a dedicated workspace and high-speed internet. The property’s condition and potential for customization should also be considered. Investing in high-quality furnishings and decor can significantly enhance the appeal of your Airbnb listing.

Ensure your Airbnb is in a location that is accessible to you or a co-host. Being nearby or having a reliable co-host is crucial for efficiently managing day-to-day operations. This proximity allows for quick response to guest issues, regular maintenance, and easier management of check-ins and check-outs.

If you or your co-host can be readily available, it ensures a higher level of service and satisfaction for guests, leading to better reviews and potentially more bookings. Additionally, being close to the property reduces the reliance on third-party services for emergency repairs or unexpected guest needs, saving time and money in the long run.

Step 6: Market Your Airbnb Listing

Similar to marketing a traditional rental property, a well-crafted Airbnb listing can make the difference between frequent bookings and a vacant property. Investors must update their listings and reflect the latest amenities, improvements, and guest feedback.

Here are some strategies to effectively create and market your Airbnb listing:

Step 7: Manage the Operations of Your Airbnb

Effective operational management helps maintain a high standard of guest satisfaction and ensures the smooth operation of your Airbnb. Advanced tools and platforms can automate many aspects of running a short-term rental, from scheduling cleanings to managing bookings and communicating with guests. A few notable tech platforms that can help improve Airbnb operations include:

| Technology Type | Benefits | Software |

|---|---|---|

| Airbnb’s tools |

| Visit Airbnb |

| Smart locks and security systems |

| Find August smart lock on Amazon |

| Channel managers |

| Visit Guesty |

| Cleaning service apps |

| Visit Handy |

| Dynamic pricing tools |

| Visit Beyond Pricing |

| Guest experience enhancements |

| Visit Touch Stay |

Frequently Asked Questions (FAQs)

How much can I realistically earn from an Airbnb business?

Earnings vary widely based on location, property type, management efficiency, and market demand. Tools like AirDNA can provide data on local occupancy and average daily rates to estimate potential earnings. However, investors should also account for expenses like maintenance, utilities, taxes, and Airbnb fees.

What are the most significant risks in running an Airbnb, and how can I mitigate them?

Common risks include property damage, periods of vacancy, changing regulations, and unexpected operational costs. Investors should have comprehensive insurance, establish strict guest screening processes, save for an emergency fund, and stay informed about local laws and market trends.

Is it better to manage my Airbnb property myself or hire a property management service?

It depends on your time, expertise, and the number of properties owned. Self-managing allows more control and potentially higher profits, but it’s time-consuming and requires a commitment to guest service, marketing, and maintenance. On the other hand, hiring a property manager eases the workload but comes with a fee.

What is the 90-day rule on Airbnb?

Airbnb’s 90-day rule restricts hosts from renting out their properties for more than 90 days a year to avoid housing shortages and minimize neighborhood disruptions. Once the limit is reached, the property cannot be rented until the following calendar year.

Bringing It All Together

Understanding the legal and financial nuances of starting an Airbnb business can help investors make informed decisions that protect their assets. From selecting the ideal property and crafting an appealing listing to effectively managing day-to-day operations, each aspect plays a vital role in the success of your rental.

Any questions about how to start an Airbnb? Let us know in the comments!

The post How to Start an Airbnb Business in 7 Steps appeared first on The Close.